We strive to add value to all aspects of your financial wellness. This includes your financial security – protecting yourself from theft of your personal data and financial information. Below are some tips we hope are useful.

Learn How to Spot a Phishing E-mail

A phishing e-mail is when a scammer sends a fraudulent e-mail hoping to trick you into revealing sensitive information or downloading / clicking on something that will give them access to your information. The sender may pose as a company or even someone you know. Scammers are getting more sophisticated and may learn how a friend or family member speaks via e-mail to impersonate them.

Here are some common red flags that can be spotted in a phishing e-mail:

Think Before You Click

Think before you click applies not only to e-mails but to text messages and messages/posts through social media as well. Scammers can even spoof a phone number to make it look like a text message comes from a number you recognize. A scammer may ask for your personal information, ask you to click on a link that could install malware on your phone, or direct you to a fraudulent website asking for credentials that they can then steal.

Legitimate companies won’t ask you for personal information via text. Watch out for texts saying things like:

- We’ve noticed suspicious activity on your account

- There’s a problem with your payment information

- A payment has been made for XYZ. Contact us if you didn’t authorize this payment

- A package (that you are not expecting) has been sent. Click for tracking information.

If you think a message might be real, contact the company using a phone number or website you know is real.

There is additional information on filtering and reporting spam text messages on the FTC website.https://consumer.ftc.gov/articles/how-recognize-and-report-spam-text-messages

Secure Your Passwords

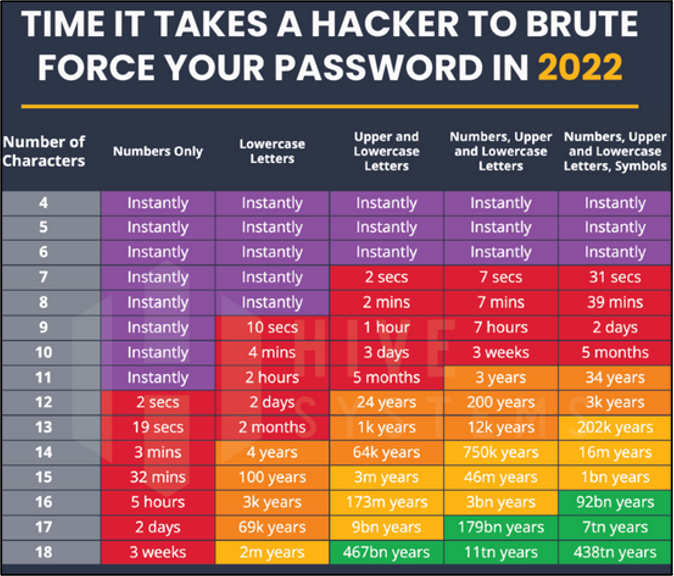

There are many helpful tips for secure passwords, including increasing password length and using a combination of upper and lower-case letters, numbers, and symbols. You may have seen a chart like this showing how difficult it is for a hacker to crack a long and complex password!

Enable Two-Factor Authentication

Two-factor authentication is a method that requires two credentials to be entered to access an account. For example, you may be prompted to enter your password, followed by a code received via text message. The password is the first factor, and the code is the second factor used to authenticate your identity. Some websites are beginning to require two-factor authentication. However, for those that don’t require it you may be able to turn it on yourself in your account settings.

Enjoy today and tomorrow, and let us do the worrying!

Contact us to discuss your situation if you’re interested in our time-horizon strategies.