Young Professionals

Helping you set and attain your financial goals

Young Professionals seek promotions and may have already changed employers. While promotions are exciting, the added employer expectations and time demands may put your investing decisions on the back burner.

Integras Partners with Young Professionals who want to be better stewards of their money. You may have scattered investments, a growing savings account, and a desire to better understand your investment opportunities. This is a great time to define your financial goals and establish behaviors that help attain them.

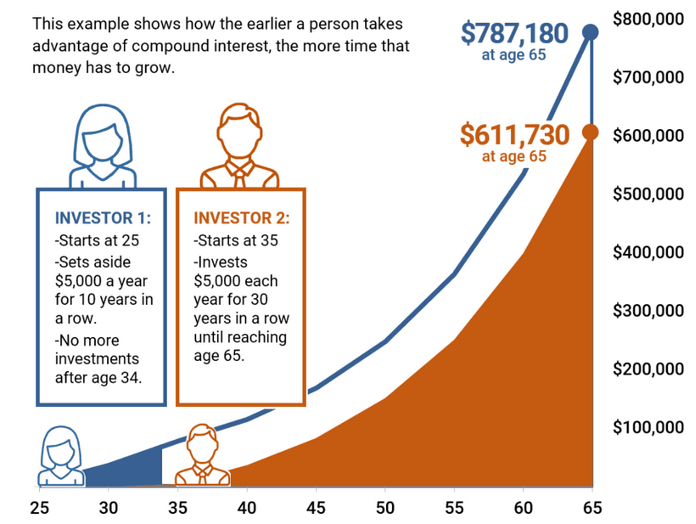

Early investors can reap tremendous returns. Investment returns compound over time, so starting early gives you a great head start towards retirement and financial independence. Even if you later need to taper down investing when starting a family or buying a home, your existing investment will continue to grow, as shown in the chart below.

Notes: Assumes an 8% interest rate, compounded annually.

Source: Catanzaro, M. (2018). How Does Compound Interest Work? Federal Reserve Bank of St. Louis

Insights for Young Professionals

Why Choose a Fiduciary Financial Advisor?

Navigating the complexities of financial planning requires trust, transparency, and a commitment to your best interests. At Integras Partners, we proudly embrace our role as fiduciary advisors, ensuring that every recommendation and strategy is aligned with your...

Focus on What You Can Control

2025 is a tumultuous year for financial markets, which understandably is rattling even the most experienced investors. While we can’t control investment returns or government policy, focusing on things that you can control may alleviate some of the anxiety. 1. Don’t...

Want to Own Stocks? Indexing is Not All That

Media personalities often recommend investing in the S&P 500 Index®. Since the indexes are really a list of stocks, you can only invest in mutual funds or Exchange-Traded Funds (ETFs) like SPY and VOO that own the list of stocks. Index funds are often chosen for their low fees.

Why a Financial Advisor Could Be Your Best Investment Yet

Working with Integras Partners brings confidence to your financial journey. We help clients not worry so much about money, knowing that an expert is minding your investments. Many individual investors let emotions and procrastination impact their decisions -...

The Goldilocks Scenario

August through October are historically the weakest and most volatile period for stocks and bonds alike. This year appears to be exceptional. Few expected the strength and resilience demonstrated by financial markets in the third quarter. The S&P 500 Index® posted...

NOW is the Perfect Time to Revisit Your 401(k)

First, you may want to read our current market commentary. It details why the markets are particularly attractive right now. You can check it out here. Employer retirement plans are often your greatest investment, for several reasons. Funds tend to stay invested...

Young Professionals – How Do I Begin Funding My Future?

For young professionals building a career, financial goals might seem far away and not get attention. It’s a fact that the sooner you begin, the greater certainty you have of reaching those goals. Not sure where to begin? Here’s what to think about first: 1) Capture...

Smarter Investing: Considering Today’s Economy and Markets

Smarter Investing

Why Target Date Funds May Miss the Mark

Most 401(k) and other retirement plans offer Target Date Funds (TDFs) as a default choice. They have become increasingly popular for a few good reasons but are rarely the best solution once your accounts achieve some size.

IRA Basics – Traditional vs. Roth

An IRA (Individual Retirement Account) is a great opportunity for younger investors to save for retirement. IRAs come in two flavors, Traditional and Roth, the main difference being when taxes apply. While traditional IRA contributions may provide a current year tax...

No matter where you stand on your financial journey, we’re here to help.

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.