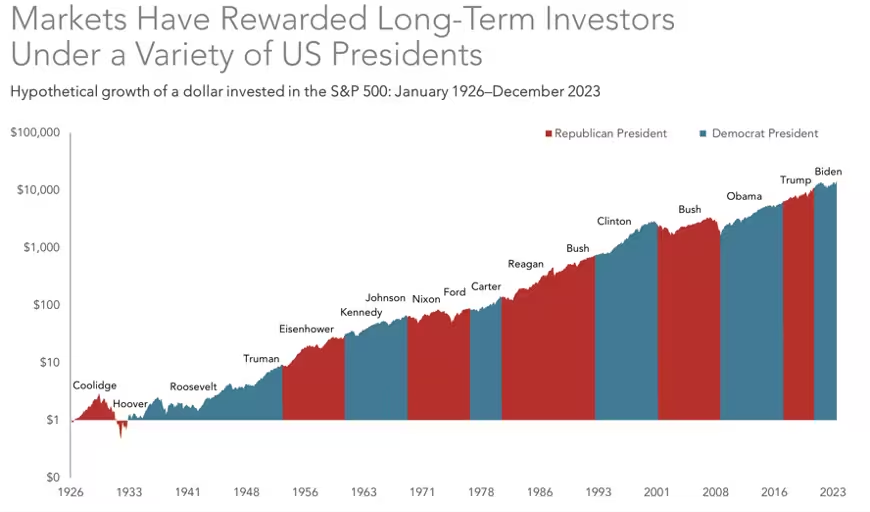

Elections can stir strong emotions, but don’t let them delay your investing. Historically, markets are influenced more by economic fundamentals than politics.

Stock values fluctuate under every president, but the S&P 500 Index® trends higher over the long term, no matter who’s in the Oval Office.

Source: Dimensional Fund Advisors

Or which party controls Congress:

Source: Dimensional Fund Advisors

Market reactions to elections create short-term volatility, but defensive changes to your investments are usually detrimental. Regardless of tax policy or regulations, factors like corporate earnings growth, economic conditions, and technological advancements have more impact on market performance.

Integras Partners with clients to keep a long-term perspective, overcome emotional delays, and take action. By keeping short-term cash needs invested with less market risk, we give clients the peace of mind to keep longer-term money invested and feel more comfortable during periods of short-term market craziness.

Contact us to discuss your situation.

Past performance is not a guarantee of future results. Data presented in the growth of $1 charts are for illustrative purposes only and is not indicative of any investment. Indices are not available for direct investment. Source; S&P data © 2024 S&P Dow Jones Indices, LLC.