Established Professionals

Helping you create the future you envision

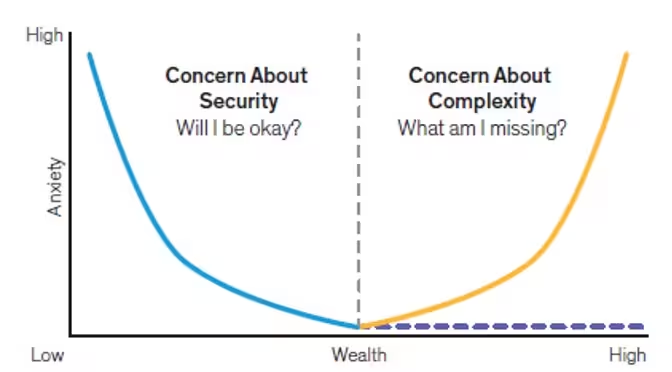

Integras Partners with Established Professionals to bring peace around finances. With thorough financial planning, we address these complexities to make sure you’re not missing investment opportunities, making tax mistakes, or taking unnecessary investment risks.

- As an independent investment advisor we bring the widest range of investment opportunities to wealthy clients without commissions.

- We also partner with your legal and tax professionals to ensure all your strategies are aligned.

- By building your plan together, we address employer benefits, education funding, risk appropriate investments, and impacting future generations.

Your dynamic plan brings peace to making life decisions. We help Established Professionals enjoy life today while creating the future you envision.

Established Professionals face greater challenges that come with success. Besides professional demands and evolving family dynamics, greater wealth adds more complexity to investment decisions and tax strategies.

We help Established Professionals enjoy life today while creating the future you envision.

No matter where you stand on your financial journey, we’re here to help.

Insights for the Established Professional

Real Estate Investments Complement Stock Risks

Article 1 of 5: Real Estate As An Investment Option This is the first in a series of five pieces to help investors understand the benefits of owning commercial real estate, then differentiate the dynamics and variety of ownership channels. For centuries, the two asset...

Is it worth relying on computers to invest your money?

As machines become more intelligent, their role as “Robo-Advisors” is destined to become more widespread. It’s popular for being a cheaper way for big firms to invest your money, but it is based on only a limited set of facts, like your age, financial stability, and...

Five Risks to Successful Retirement

Many people have unanswered questions about setting themselves up for a successful retirement. Below are the primary risks to consider and some general ideas for overcoming them. We help our clients with these strategies, which starts with identifying the...

5 Strategies Built to Match Your TimeLine

Why Integras? Broad asset allocation based on “risk scores” assumes more risk than aligning investments to fund specific goals. So, we take little risk with money you...

Are Taxes Keeping You From Selling Investment Real Estate?

Typically, selling an investment property like a rental home or an office building will trigger taxes on the amount of gain. This may stop people unaware there is a way to defer these taxes. The IRS allows a property seller who reinvests all the proceeds into one or...

Tips to Keep Your Personal Data Safe

We strive to add value to all aspects of your financial wellness. This includes your financial security – protecting yourself from theft of your personal data and financial information. Below are some tips we hope are useful. Learn How to Spot a Phishing E-mail A...

Are You Watching Your Account Balances Shrink?

Watching your account balances shrink during down markets is never easy. Behavioral economists tell us that the pain people feel watching their investments decline is twice as powerful as the joy of gains. A period of market volatility like we have been experiencing...

Would you like to have Nobel Laureates help with your investments?

We are among a select group of advisors who directly trade with Dimensional Fund Advisors (DFA). This mutual fund family was started in 1981 by alumni of the Booth School of Finance at The University of Chicago with the idea that stock markets are efficient and reward long-term investors.

Realizing Your Dream in Retirement

Paul and Maria came to us for clarity on their retirement readiness and advice on strategies for moving forward.

We helped them realize that dream when they have only the lake home mortgage, supported by income from the retirement accounts and two social security checks.

Retirement Wisdom: Do I Take the Company Pension?

When faced with a layoff or early retirement, this can be the most difficult decision. We’ve helped hundreds of clients weigh the options, so here are some questions that may be of help to you. Is my former employer financially stable and is the pension...

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.