Many families list paying for a child’s college education as an important financial goal, yet are unsure how much to save. College tuition costs have increased much faster in recent decades than any other household expense. J.P. Morgan recently projected that a four-year college education for a child born today will cost between $250k and $580k (ranging from public in-state tuition to private tuition). At the same time, financial aid awards have declined.

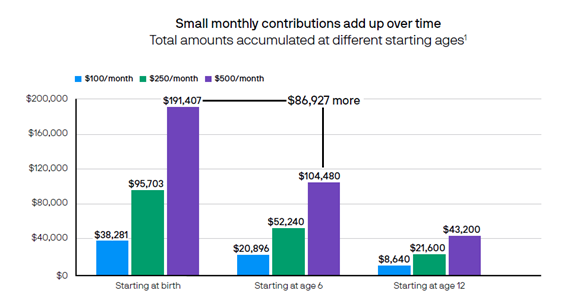

If you’re the parent of a newborn, the need for college planning may seem far in the future. But starting early can make a huge difference, even if making small monthly contributions.

A tax-advantaged savings vehicle has the potential to grow faster, as taxes aren’t taking a bite out of your investment returns.

In honor of National 529 Day on May 29th, here we highlight some facts about 529 accounts as a tax-advantaged vehicle for saving and investing for college.

- You may get an income-tax break on contributions made to a 529 offered by the state you live in.

- Money saved in a 529 has the potential to grow tax-free. Earnings on the money contributed are not taxed while in the 529 account, and money can be withdrawn free from federal income tax if used for qualified educational expenses, including an amount for room and board, and even an annual amount for K-12 education.

- Most states also don’t impose state income tax on qualified withdrawals.

- Taking money out of a 529 for non-educational expenses triggers tax and penalty only on the gains.

- The beneficiary of a 529 account can be changed at any time to another family member or even to yourself. And there is no limit on how long a 529 account can exist – theoretically allowing an account to be passed down generations.

- Family and friends can make contributions to your child’s 529, and if a non-parent is the account owner, the money in the 529 plan does not impact federal financial aid.

- Subject to certain limitations, up to $35,000 of unused money in a 529 account can be rolled over to a Roth IRA in the beneficiary’s name, without any taxes or penalties related to taking money out for non-educational expenses.

1 J.P. Morgan Asset Management. This hypothetical example illustrates the future values at age 18 of different regular monthly investments for different time periods. Chart also assumes an annual investment return of 6%, compounded monthly. Investment losses could affect the relative tax-deferred investing advantage.