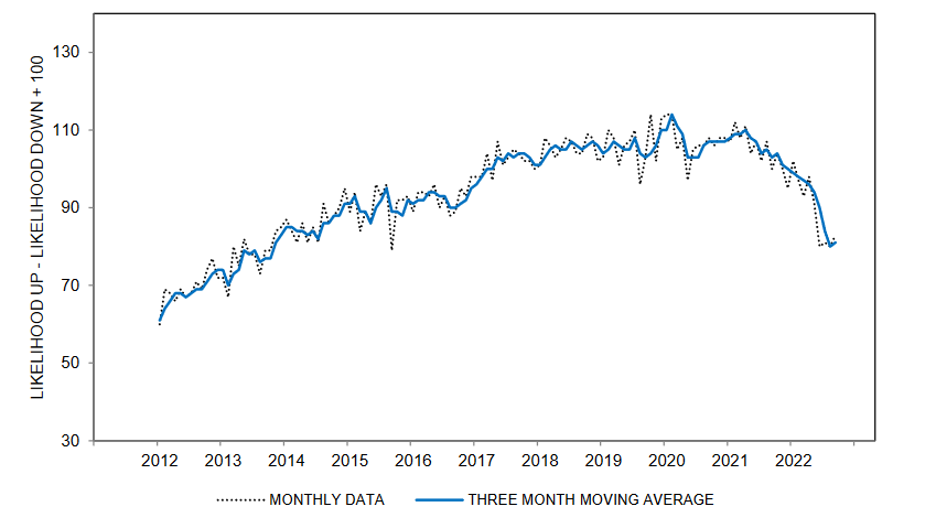

In an ongoing University of Michigan survey, older Americans recently expressed less confidence about having a comfortable retirement.[1]

Inflation is the likely driver of this worry (both inflation itself and the affect it has had on the stock market). To top it off, the inflation that retirees actually experience is typically higher than the headline numbers. This is because retirees spend more on services, such as healthcare and housing, which tend to have a higher inflation rate than goods.

Integras Partners developed investment strategies with retirees in mind. Investment risks needed for growth are limited to longer timeframes. So, money for short-term needs is shielded from market risk. Each client’s unique portfolio allocation is driven by our financial planning process, which accounts for anticipated spending and ongoing inflation.

Our goal is to help you enjoy retirement with peace of mind. Reach out to us to talk about your situation.

[1] The University of Michigan, Survey Research Center, Surveys of Consumers

Enjoy today and tomorrow, and let us do the worrying!

Contact us to discuss your situation if you’re interested in our time-horizon strategies.