The Fed remains reluctant to lower short-term interest rates, as the inflation outlook heads back up towards 3%. Slowing economic growth and sustained employment weakness would prompt rate cuts.

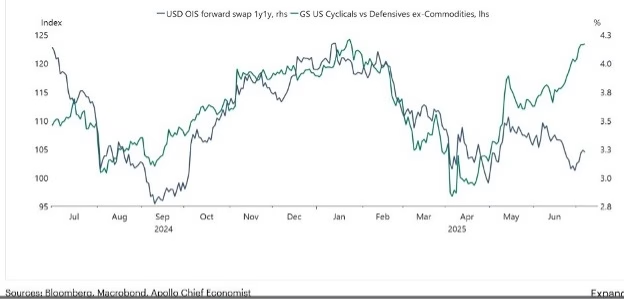

The technical chart below reflects that the bond market is expecting slower economic growth. Projections are for two interest rate cuts before the end of the year.

Equity markets are signaling the opposite, by valuing cyclical stocks higher than defensive stocks. This happens when the broad market expects an acceleration of economic growth (which leads to higher rates).

Both cannot be right. Either the bond market is wrong and interest rates will move higher, or the stock market is wrong and will see declines. No one knows which it will be. This is the dilemma investors face when positioning their portfolios.

At Integras Partners, we recently increased our more defensive allocations. Markets are shrugging off multiple concerning trends. There are downside risks in a cautious U.S. consumer, slowing economic growth, and weaker employment data not yet reflected in market valuations.

We have concentrated our growth allocations in those sectors less likely to be negatively impacted – sectors where strong secular growth trends remain in place.

It is our nature to err on the side of caution. Chasing returns is not our primary objective. We are motivated every day to ensure that our clients are positioned to enjoy their lifestyle, without worrying about what’s going on short-term in the markets.