Established Professionals

Helping you create the future you envision

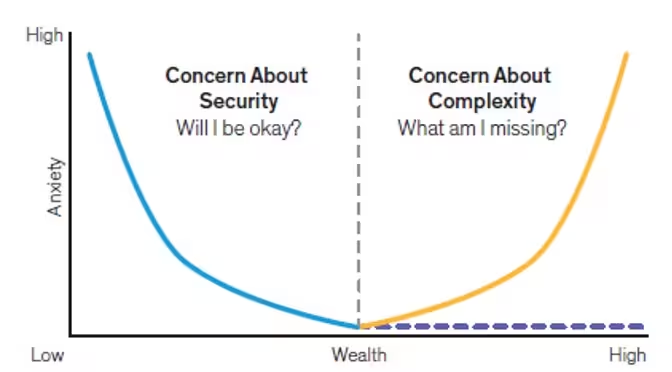

Integras Partners with Established Professionals to bring peace around finances. With thorough financial planning, we address these complexities to make sure you’re not missing investment opportunities, making tax mistakes, or taking unnecessary investment risks.

- As an independent investment advisor we bring the widest range of investment opportunities to wealthy clients without commissions.

- We also partner with your legal and tax professionals to ensure all your strategies are aligned.

- By building your plan together, we address employer benefits, education funding, risk appropriate investments, and impacting future generations.

Your dynamic plan brings peace to making life decisions. We help Established Professionals enjoy life today while creating the future you envision.

Established Professionals face greater challenges that come with success. Besides professional demands and evolving family dynamics, greater wealth adds more complexity to investment decisions and tax strategies.

We help Established Professionals enjoy life today while creating the future you envision.

No matter where you stand on your financial journey, we’re here to help.

Insights for the Established Professional

NOW is the Perfect Time to Revisit Your 401(k)

First, you may want to read our current market commentary. It details why the markets are particularly attractive right now. You can check it out here. Employer retirement plans are often your greatest investment, for several reasons. Funds tend to stay invested...

Are Family Pressures Challenging your Retirement?

Glen & Amber are sandwiched between their elder parents and three children, ages 15-24. Glen has been managing their investments on his own and would like to retire from his corporate job. With family pressures complicating this decision, friends referred them to...

Planning Now Could Reduce Taxes in Retirement

First, let’s look at the three types of accounts by their tax treatment. Tax-Deferred Retirement Accounts are funded with untaxed dollars (contributions are tax deductible, either through salary-deferral or on your tax return). However, future withdrawals are fully...

Smarter Investing: Considering Today’s Economy and Markets

Smarter Investing

Facts You May Not Know About 529 Accounts

If you’re the parent of a newborn, the need for college planning may seem far in the future. But starting early can make a huge difference, even if making small monthly contributions.

Why Target Date Funds May Miss the Mark

Most 401(k) and other retirement plans offer Target Date Funds (TDFs) as a default choice. They have become increasingly popular for a few good reasons but are rarely the best solution once your accounts achieve some size.

The New FAFSA

Changes to the FAFSA form and the formula for determining a family’s need for aid are changing, effective for the 2024-2025 school year. While all the changes are beyond the scope of this post, here we highlight two from a financial planning perspective. Parent...

Light at the End of the Tunnel

Laser-focus on inflation was the key driver of both interest rates and market performance over the past two years.

Reflecting on 2023

While the S&P 500 rose 26% at the headline level, it was almost entirely due to just seven “magnificent” tech stocks.

Closing the Gender Gap in Investing

19% of women report feeling confident selecting investments that align with their goals

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.