Established Professionals

Helping you create the future you envision

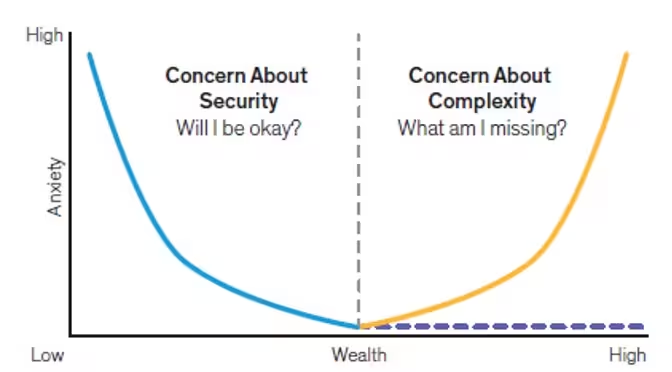

Integras Partners with Established Professionals to bring peace around finances. With thorough financial planning, we address these complexities to make sure you’re not missing investment opportunities, making tax mistakes, or taking unnecessary investment risks.

- As an independent investment advisor we bring the widest range of investment opportunities to wealthy clients without commissions.

- We also partner with your legal and tax professionals to ensure all your strategies are aligned.

- By building your plan together, we address employer benefits, education funding, risk appropriate investments, and impacting future generations.

Your dynamic plan brings peace to making life decisions. We help Established Professionals enjoy life today while creating the future you envision.

Established Professionals face greater challenges that come with success. Besides professional demands and evolving family dynamics, greater wealth adds more complexity to investment decisions and tax strategies.

We help Established Professionals enjoy life today while creating the future you envision.

No matter where you stand on your financial journey, we’re here to help.

Insights for the Established Professional

Factors to Consider When Retiring with a 401(k)

Planning to retire with a 401(k)? Discover key factors to consider—from taxes to withdrawal strategies—to maximize your retirement savings.

Summer is Here – Give your Kids a Head Start on Building Wealth

Many schools don’t teach Financial Literacy. Beyond a formal education, one of the most powerful gifts you can share is how to manage money. Encourage them to get started with investing early. Compounding returns over time is like a rolling snowball...

Why Choose a Fiduciary Financial Advisor?

Navigating the complexities of financial planning requires trust, transparency, and a commitment to your best interests. At Integras Partners, we proudly embrace our role as fiduciary advisors, ensuring that every recommendation and strategy is aligned with your...

Focus on What You Can Control

2025 is a tumultuous year for financial markets, which understandably is rattling even the most experienced investors. While we can’t control investment returns or government policy, focusing on things that you can control may alleviate some of the anxiety. 1. Don’t...

Want to Own Stocks? Indexing is Not All That

Media personalities often recommend investing in the S&P 500 Index®. Since the indexes are really a list of stocks, you can only invest in mutual funds or Exchange-Traded Funds (ETFs) like SPY and VOO that own the list of stocks. Index funds are often chosen for their low fees.

We Can Help with Important Conversations that Families Avoid

As we age, living situations and health needs will change. Parents and their children avoid planning for them, for very understandable reasons: Parents don’t “want to be a bother”. Kids “don’t want to pry” into their parents’ lives. Money conversations can be tense....

Why a Financial Advisor Could Be Your Best Investment Yet

Working with Integras Partners brings confidence to your financial journey. We help clients not worry so much about money, knowing that an expert is minding your investments. Many individual investors let emotions and procrastination impact their decisions -...

The Goldilocks Scenario

August through October are historically the weakest and most volatile period for stocks and bonds alike. This year appears to be exceptional. Few expected the strength and resilience demonstrated by financial markets in the third quarter. The S&P 500 Index® posted...

NOW is the Perfect Time to Revisit Your 401(k)

First, you may want to read our current market commentary. It details why the markets are particularly attractive right now. You can check it out here. Employer retirement plans are often your greatest investment, for several reasons. Funds tend to stay invested...

Tax Smart Investing for Your Kids

Everyone wants their kids to succeed and help them financially. As always, starting early pays the greatest benefits. Here are some timely ideas: 529 plans allow you to invest cash for school expenses tax free. These accounts are typically owned by a single parent,...

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.