Career Builders

Helping you set and attain your financial goals

Career Builders seek promotions and may have already changed employers. While promotions are exciting, the added employer expectations and time demands may put your investing decisions on the back burner.

Integras Partners with Career Builders who want to be better stewards of their money. You may have scattered investments, a growing savings account, and a desire to better understand your investment opportunities. This is a great time to define your financial goals and establish behaviors that help attain them.

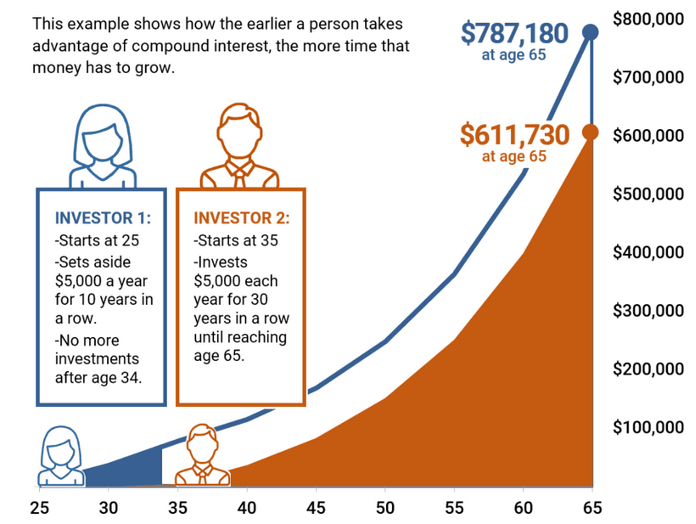

Early investors can reap tremendous returns. Investment returns compound over time, so starting early gives you a great head start towards retirement and financial independence. Even if you later need to taper down investing when starting a family or buying a home, your existing investment will continue to grow, as shown in the chart below.

Notes: Assumes an 8% interest rate, compounded annually.

Source: Catanzaro, M. (2018). How Does Compound Interest Work? Federal Reserve Bank of St. Louis

Insights for the Career-Minded

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No matter where you stand on your financial journey, we’re here to help.

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.