Career Builders

Helping you set and attain your financial goals

Career Builders seek promotions and may have already changed employers. While promotions are exciting, the added employer expectations and time demands may put your investing decisions on the back burner.

Integras Partners with Career Builders who want to be better stewards of their money. You may have scattered investments, a growing savings account, and a desire to better understand your investment opportunities. This is a great time to define your financial goals and establish behaviors that help attain them.

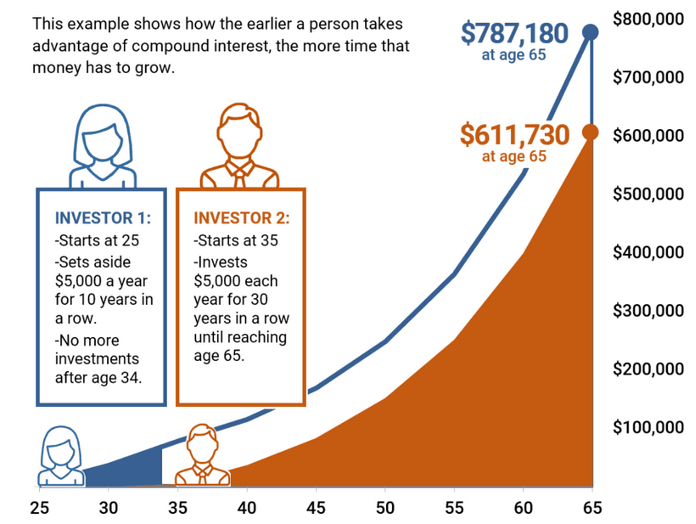

Early investors can reap tremendous returns. Investment returns compound over time, so starting early gives you a great head start towards retirement and financial independence. Even if you later need to taper down investing when starting a family or buying a home, your existing investment will continue to grow, as shown in the chart below.

Notes: Assumes an 8% interest rate, compounded annually.

Source: Catanzaro, M. (2018). How Does Compound Interest Work? Federal Reserve Bank of St. Louis

Insights for the Career-Minded

Closing the Gender Gap in Investing

19% of women report feeling confident selecting investments that align with their goals

Where are the Opportunities in Today’s Markets?

Bullish sentiment ran out of steam during Q3 2023. In a previous blog we discussed the primary culprit for that. All that said, we are now in the final quarter of the year.

Will Rising Interest Rates Cause a Recession?

August, September, and October are historically the worst three months for market performance and 2023 was no different. Everything but cash, oil and short-term treasuries had negative 3rd quarter returns. The S&P 500 lost 3.25%, small caps fell 5%, international markets dropped 3.5%, and long-term treasuries lost an astounding 8%.

Finding Value in Overlooked Sectors

The big question for investors now is where to be invested going forward. With the overall market trading at 20x earnings and first half gains concentrated into only a select few stocks, most of the market has been left behind. With the valuations of the high-fliers...

Young Professionals: Establish Healthy Investing Habits

Meet Megan. She’s in her early 30s, single (for now) and fairly stable in her career, although she may change employers. Like most younger professionals we work with, Megan was unsure how to get started. She had a couple of previous company retirement accounts and a...

No matter where you stand on your financial journey, we’re here to help.

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.