Established Professionals

Helping you create the future you envision

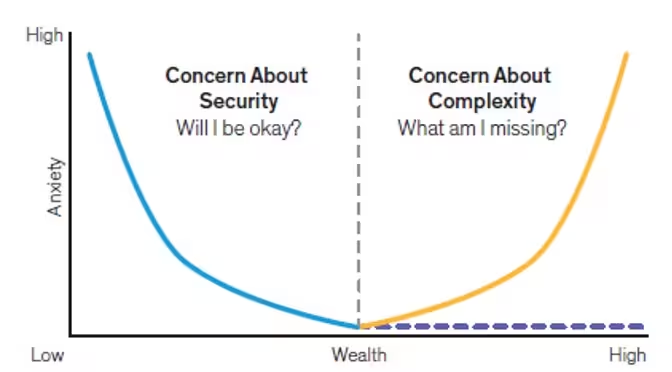

Integras Partners with Established Professionals to bring peace around finances. With thorough financial planning, we address these complexities to make sure you’re not missing investment opportunities, making tax mistakes, or taking unnecessary investment risks.

- As an independent investment advisor we bring the widest range of investment opportunities to wealthy clients without commissions.

- We also partner with your legal and tax professionals to ensure all your strategies are aligned.

- By building your plan together, we address employer benefits, education funding, risk appropriate investments, and impacting future generations.

Your dynamic plan brings peace to making life decisions. We help Established Professionals enjoy life today while creating the future you envision.

Established Professionals face greater challenges that come with success. Besides professional demands and evolving family dynamics, greater wealth adds more complexity to investment decisions and tax strategies.

We help Established Professionals enjoy life today while creating the future you envision.

No matter where you stand on your financial journey, we’re here to help.

Insights for the Established Professional

Strategies for Charitable Giving – Part 2

If you are already charitably inclined there are two gifting strategies that you should be aware of, Qualified Charitable Distributions (QCDs) and gifting appreciated stock.

Strategies for Charitable Giving – Part 1

If you are already charitably inclined there are two gifting strategies that you should be aware of, Qualified Charitable Distributions (QCDs) and gifting appreciated stock. To realize tax benefits for 2023, both need to be done before the end of the year.

Where are the Opportunities in Today’s Markets?

Bullish sentiment ran out of steam during Q3 2023. In a previous blog we discussed the primary culprit for that. All that said, we are now in the final quarter of the year.

Will Rising Interest Rates Cause a Recession?

August, September, and October are historically the worst three months for market performance and 2023 was no different. Everything but cash, oil and short-term treasuries had negative 3rd quarter returns. The S&P 500 lost 3.25%, small caps fell 5%, international markets dropped 3.5%, and long-term treasuries lost an astounding 8%.

Do You Still Have Money in a Previous Employer’s 401(k) Plan?

If you reached age 55 in your last year with the company, you’re eligible to access funds without early withdrawal penalties. Consider leaving an amount you might need to withdraw before age 59 ½, which is the penalty-free age for IRA’s.

Finding Value in Overlooked Sectors

The big question for investors now is where to be invested going forward. With the overall market trading at 20x earnings and first half gains concentrated into only a select few stocks, most of the market has been left behind. With the valuations of the high-fliers...

Will partnering with a Trusted Advisor help you find Peace of Mind?

Several years ago, a client couple referred their neighbors. Let’s call them Jim and Kate. They had been married almost 20 years and had established careers and two younger children. After recently purchasing their dream home, they came to us to help...

Partner with Us

Let's begin our conversation to see how we can help you reach your goals.